WHAT'S IN A SCORE?

What you should know regarding your FICO score.

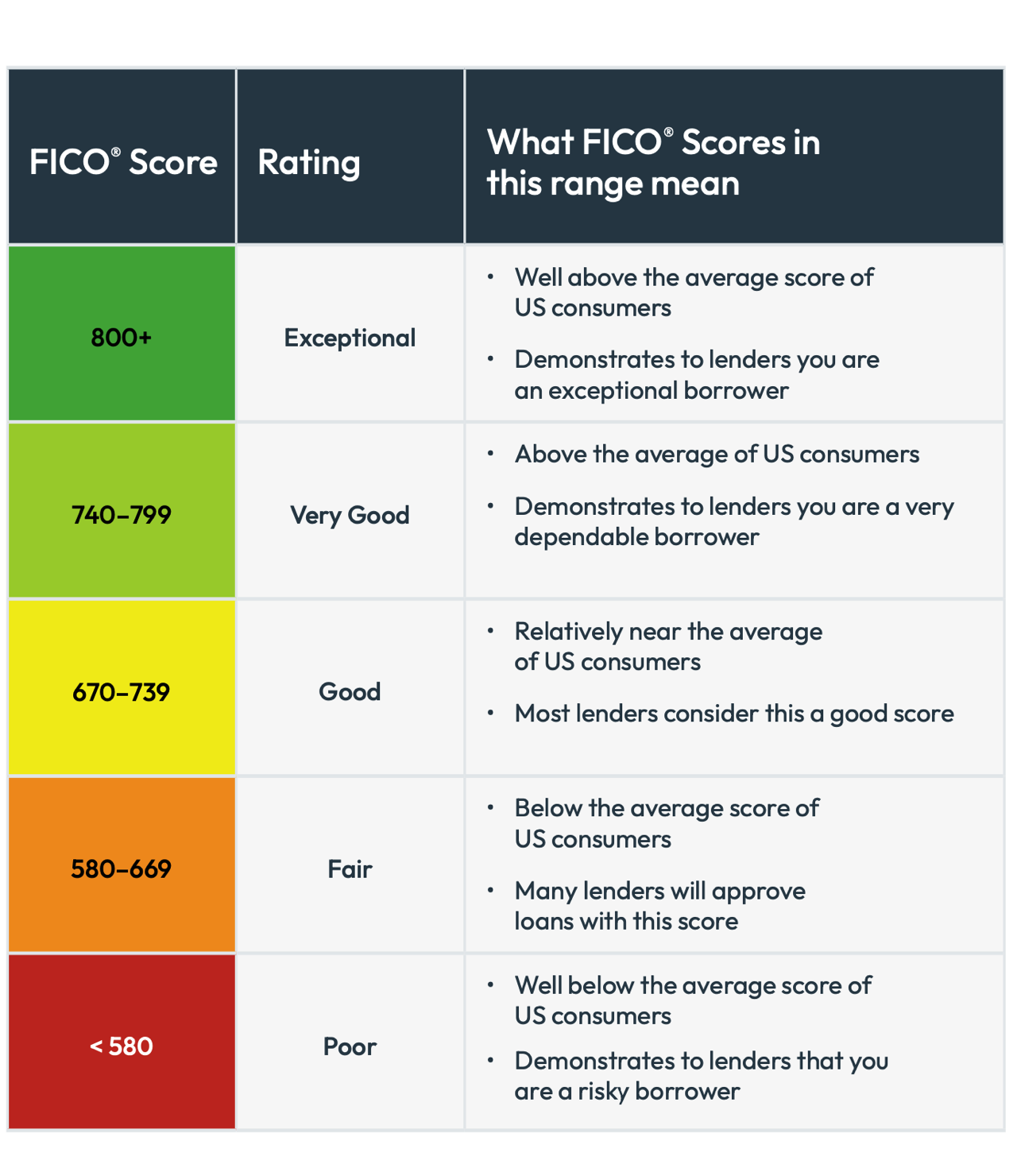

FICO® Scores generally range from 300 to 850, though industry-specific FICO Scores have a slightly broader 250 to 900 score range (more on the different FICO Score versions on page 8). Higher FICO Scores demonstrate lower credit risk, and lower FICO Scores demonstrate higher credit risk.

What’s considered a “good” FICO® Score varies by lender. For example, one lender may offer its lowest interest rates to people with FICO Scores above 730, while another lender only offers its lowest interest rates to people with FICO Scores above 760.

FICO is the BASIS of MOST Decisions re Your WORTHINESS.

Here’s a chart that breaks down the ranges of

FICO® Scores found across the US consumer

population. Again, each lender has its own credit

risk standards, but this chart will give you a sense of

what a FICO Score in a particular range means.

Where do You Stand?

Please Note:

You have the right to ask for a credit score. Credit scores are numerical summaries of

your credit-worthiness based on information from credit bureaus. You may request a

credit score from consumer reporting agencies that create scores or distribute scores used

in residential real property loans, but you will have to pay for it. In some mortgage

transactions, you will receive credit score information for free from the mortgage lender.